Beauty brands are still exclusive, and it's not just because of race

Men are seeking good skincare and makeup, but beauty brands lag behind as this demand has not been met.

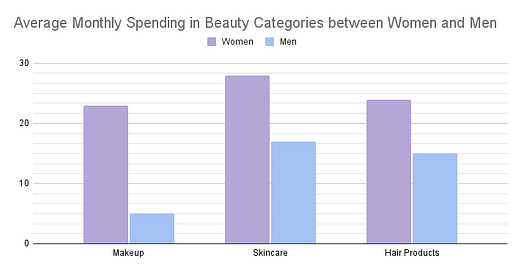

The beauty industry has a female-dominated audience. A March 2023 article found that average spending in the US across multiple beauty categories is about 50% higher for women than men. Due to stereotypical perceptions of masculinity, there are limited cosmetic products tailored toward men. We’re now beginning to see a shift in how emerging beauty brands are creating products specific to men and neglecting the notion that skincare and makeup aren’t masculine enough.

Men care about self-care — look at the grooming industry

Grooming is the umbrella term to describe the beauty sector for men. While we’ve seen gender inclusivity with perfume and hair products, that can’t be said for skincare and makeup. Shaving will continue to be a booming industry, as it takes up a significant proportion of men's grooming spending. Notable brands, such as Harry’s and Dollar Shave Club have grown successful with business models that maximize convenience, quality, and price. Their growth is indicative that men do care about how they look, as CNN also shares that social media and male influencers have shared beliefs that men should embrace self-care.

While looking through annual reports of large beauty retailers, such as Sephora and Ulta, I found it surprising that there is no mention of promoting male skincare or makeup products. Even if male-specific brands already exist at these stores, there is low brand awareness. These brands will face pressure as emerging brands reach social media audiences that advertise products to men.

The UK uses celebrity ads and celebrity-founded brands to boost men’s spending on makeup & skincare

The UK has seen men’s consumer spending towards beauty increase and active efforts by celebrities and brands to promote men’s cosmetics and skincare. ClearPay, a buy now pay later platform, found that beauty spending among UK men grew 77%. Male celebrities have identified this potential market and have launched their beauty brands. Take Harry Styles, who founded Pleasing, a brand that offers a range of beauty products. This launch makes sense, as Styles is known for rejecting traditional masculine roles and expressing himself in ways that he sees fit. Men’s products typically use darker tones for branding colors, but Pleasing takes a unique approach with bright colors.

A lack of community hinders men’s potential to explore & invest in makeup, limiting growth in the grooming industry

A larger part of why directing skincare and makeup towards men has not been a larger initiative is because brands know that they won’t be able to achieve the scale that women’s cosmetics have. While the men’s grooming market is expected to be worth $115B by 2028, there’s a reason why Unilever sold Dollar Shave Club to a PE firm and Every Man Jack is up for sale.

There’s a lack of community. The prevalence of men using skincare and makeup publically is in its early stages but will be a large influence in driving sales. User-generated content is 10 times more influential in the purchase decision than influencer or branded content. If makeup brands can direct their marketing to men and foster an atmosphere of experimentation, people will likely use TikTok to review which existing or new products work for men. Right now, there has been a 389% increase in TikTok video views around male skincare search terms, so I’m bullish that we’ll start to see more men making “get ready with me” videos

thanks for reading!

Sanjana