breaking down trends @ expo west & diving deep into crumbl cookie's tiktok reviews

Today’s read is a bit long, but I had so much fun writing it. I talk about Expo West, one of the largest natural products conventions for existing brands to expand their visibility and emerging brands to test new products. I also dive into Crumbl Cookie’s growth because I’m still getting TikToks of people reviewing their cookies every week. All in all, my hours on TikTok inspired a lot of the topics and trends I wanted to touch on, so maybe there is a benefit to keeping the app😅

Startup Events & News

A list of startup events happening in April — let’s get you plugged into the Minnesota startup ecosystem♥️

4/5 - CPG Resource Round Up

4/11 - MN Entrepreneur Kick-Off @ Minneapolis Club

4/17 - Founder’s Happy Hour @ North House MSP

What’s Happening in Consumer

Macro Trends: Expo West Deep-Dive

Micro Trends: Crumbl Cookie Reviews, Influencing Normal Brands

From a Macro View

macroeconomic consumer trends, shifts in consumer behavior, industry deep dives

Expo West, one of the largest CPG trade shows in the US, just happened a couple of weeks ago. Thousands of brands and retailers come together to market new products and break into the US market. From date snacks to drinkable yogurt (bringing back Danimal’s!) to even miso soup, this event is a pivotal time for retailers and investors to source new trends and seek their next investment. Here are a few trends I found when reading up on the week-long event:

Functional mushrooms

An article from Modern Retail talks about the consistent trend in “plant-powered” food that was not only used as a meat substitute but also as a functional food. Mushrooms are a covid trend that has continued to grow in the market. Expo West brought startups selling functional beverages, such as Rowdy Mermaid’s kombucha, and even food, such as Eat The Change’s mushroom jerky. These product expansions into the functional food market hone in on the broader shift in consumers seeking healthier, nutrient-rich food.

While I haven’t seen talk of functional mushrooms in among GenZers just yet, I’m confident that the expansion in product variety signals that this will be a strong trend. Instacart’s 2024 Trend Report supports this, as they found that Lion Mane mushrooms experienced a near 600% growth in order share from 2022 to 2023.

Similar trends like Bloom’s green juice and sleepy girl mocktails explain why people are interested in functional mushrooms as well. These small additions to our routines emphasize a sustainable trend in healthful, nutrient-dense food consumption.

Quick Bites (with an ethnic twist)

Another Expo West trend is the rise in convenient, quick snacks tied to various global flavors. Laoban Dumplings’s thesis hones in on quality and convenience, as their website quotes “culinary excellence and convenience can coexist harmoniously”.

Emerging brands entering this space likely stem from Gen Z grocery shopping at Trader Joe’s. The chain attracts individuals who are early adopters of new products, strive for healthy meals, and are open to a variety of cuisines without sacrificing hours in the kitchen. Some of the more popular items have been inspired by global flavors. For example, Trader Joe’s butter chicken or soup dumplings sweep my social media pages. A 2023 article pointed out the growth in frozen food sales during the pandemic and air fryer use helped drive Trader Joe’s to become a leading storefront for grocery. These broad shifts that shaped Gen Z to Trader Joe’s explain the ripple effect of new brands at Expo West capitalizing on this movement.

Natural Sweeteners

My TikTok feed is filled with stories about how quitting sugar has completely changed people’s physical and mental health for the better. A 2023 Food and Healthy survey found that 72% of consumers are looking to limit or avoid sugar. Though it would be nice to have a sharp jawline, it’s almost impossible to quit sugar given that almost everything has added sugar. However, with several brands at Expo West sharing our favorite products made with natural sweeteners, maybe there’s hope that we can lower our sugar intake and live our best life. Brands like Date Better, date treats, and ChiChi, chickpea oatmeal, prioritize natural ingredients to reflect the 6% CAGR growth in the natural sweeteners market.

From a Micro View

micro-trends, with a glimpse into the Gen Z world

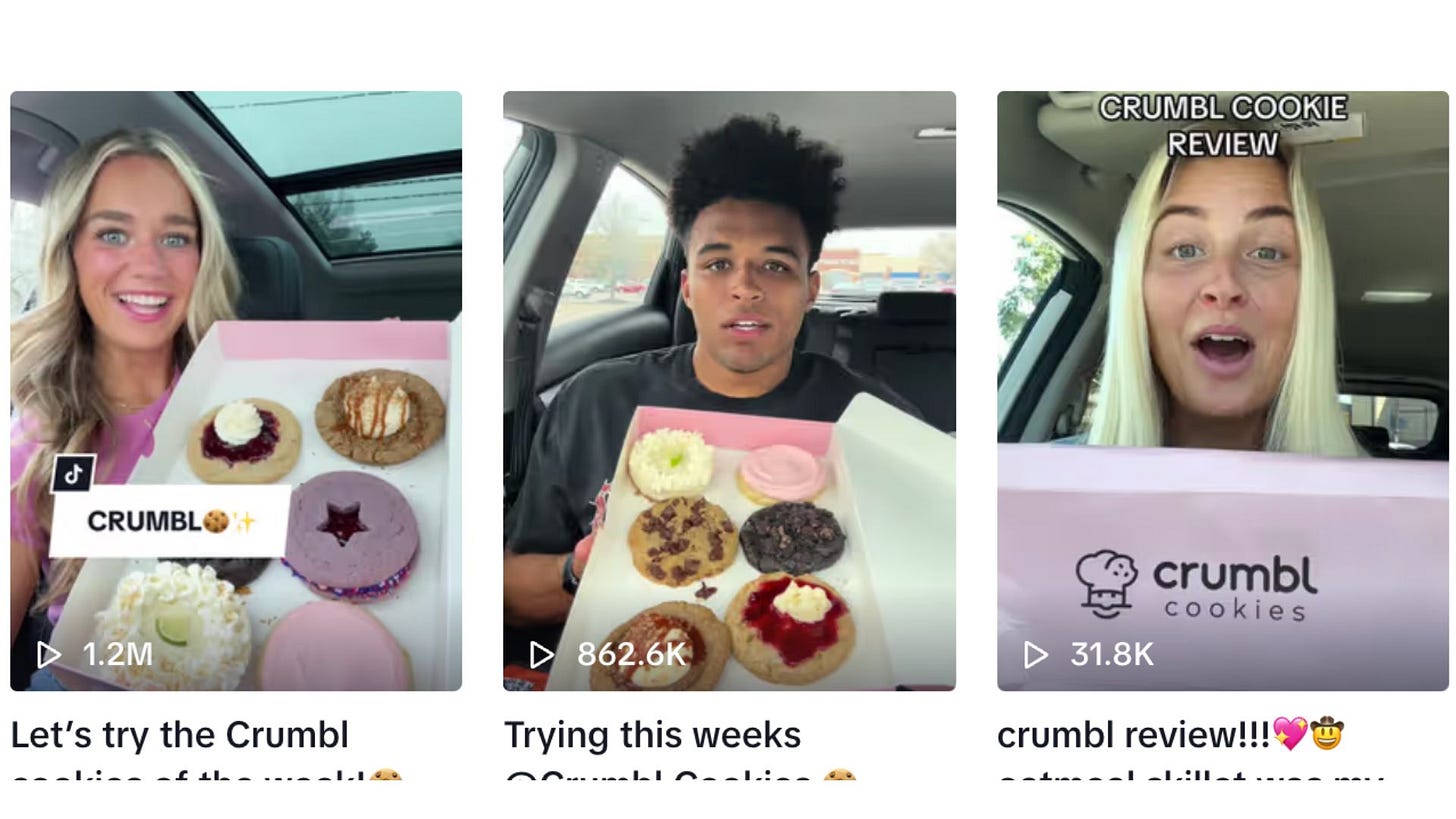

Crumbl Cookie Reviews are still a thing

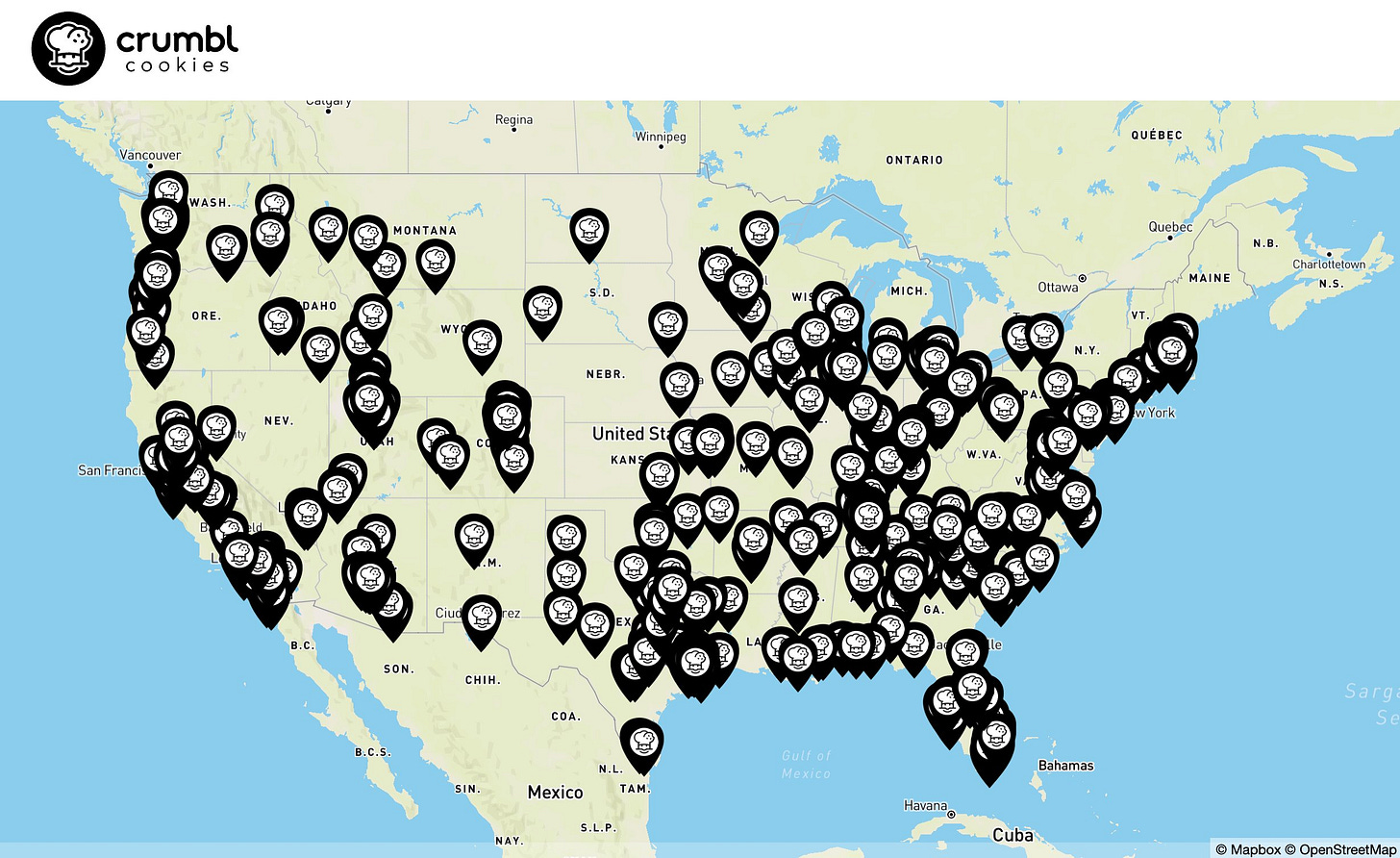

To all those that say consumer doesn’t win, Crumbl Cookie is a perfect example to go against the claim. Founded in 2017, the brand has exceeded over $1B in sales with 980 locations nationwide. It’s a bit ironic that despite a trend towards healthier eating, Crumbl Cookie has managed to experience rapid growth in the last eight years. This is likely due to three key factors that I’ll be diving into: virality, innovative flavors, social media use.

Using hype cycles to create virality : Crumbl Cookie’s business model is built on creating a “hype cycle” through its weekly rotating menu. As said before, Gen Z thrives off of product discovery, as an article points out that 77% of Gen Z adults make an effort to try new brands. It is incredibly difficult to manage a weekly rotating menu, but that is key to Crumbl’s unique competitive advantage. The excitement that customers feel each week has sparked a trend of people reviewing the new flavors that drop. Content creators have used Crumbl reviews to attract following, such as The Hungry Foodie, a creator who has received up to a million views from a Crumbl Cookie review.

Innovative Flavors : Crumbl started out making a signature chocolate chip cookie and sugar cookie. So far, the brand has 200+ rotating flavors that take inspiration from other desserts and familiar foods (i.e., Recess PB Cup, Buttermilk Pancake). From ideation to execution, innovating flavors requires a meticulous and robust process to ensure that customers are excited to try the new products.

Social Media: Crumbl’s successful social media use is first tied to the brand color palette. The classic Crumbl pink colored box paired with a simple logo makes this brand immediately “Instagrammable”. Achieving this aesthetic makes it much easier for Crumbl to gain popularity organically, especially with a Gen Z-dominated audience. Compared to other QSR restaurants that sell cookies, Crumbl leads with their social media presence.

Influencing Normal Brands

I recently came across a TikTok of a girl sharing her go-to products of what she calls “normal” brands. She highlights brands like Pantene and Dove to signal that popularized product brands don’t have to be part of your everyday routine. With overstimulated promotions and sponsorships of new brands on social media, it’s refreshing to see content creators highlight that products that have been around for decades still retain their effectiveness. A 2024 Mintel Haircare report found that consumers resonate with this type of media as it shows that 30% of haircare users shop in drug stores. This marks an important element of consumerism — moderation. As Gen Z shoppers become more conscious of how they spend their money, sometimes we need the reality check that we don’t need to purchase every new brand hitting the market. That being said, consumers must put pressure on massive, long-standing brands from an ethics and sustainability view.

What I’m working on

what I’m thinking, reflections & upcoming projects

I am excited about Consumer Girl. I have a lot of ideas, from interview blogs to new topics to share perspectives on. I am constantly scouring the internet to learn about how people discover consumer trends and how Gen Z behavioral shifts disrupt certain market segments. I’m putting out an ask if anyone knows any consumer startups or investors who would be open to speaking at an event or being interviewed — please send any recommendations my way!

If you made it to the end, thank you so much for reading!

Sanjana