corporate gen z - the demographic new brands need to win over

Gen Z corporates are becoming an increasingly powerful demographic for brands to capture.

2025 is here! Excited for all the fun trends to write about this year in all things consumer. With CES and NRF wrapping up these last couple weeks, I can’t wait to share my thoughts on these conferences soon. Today, my piece is about Gen Z corporates, a demographic brands should pay more attention to. Let me tell you why.

They understand rapid product hype cycles of products from living through college and deciding which product is worth spending their $15/hour income on.

They care about environmental sustainability, so that means investing in products at a higher price but with better quality and longevity.

As the first “digitally native” generation, they are adept at discovering new products on social media and are more willing to pay for them.

More people are living at home the first few years out of college, giving them extra room to spend their disposable income.

It’s projected that Gen Z will make up about 30% of the US workforce by 2030. And with Gen Z spending power projected to reach $12T by 2030, brands are at a clear advantage if they can win over this crowd.

So today’s piece is about the winning brands that successfully target Gen Z corporate consumers. This is definitely NOT an exhaustive list. Most are incumbent brands because it’s not easy for brands to become integral to any consumer’s routine spending. I asked 10-15 friends to share their insights and have scattered their recommendations throughout my list.

Latest Consumer News:

Bero, Tom Holland’s non-alcoholic beer brand, is now available in all Target stores

Simple Mills was acquired by Flower Foods for $795M

Magic Spoon is now in Whole Foods nationwide

Softside experienced nearly 5 million case depletions in 2024, up from 1.3M the prior year.

Travel & Tech

Tumi

Away: Away was one of the first DTC brands to make hard-shelled luggage THE suitcase to buy and compete against incumbent brand Tumi for market share. In its first year alone, it exceeded $12M in sales and sold more than 100K suitcases.

While many of these features are now ubiquitous across brands, Away pioneered new product features, such as integrated locks, in-bag compression, and a folded-in laundry bag. Social media and content marketing are at the core of its success now, as it sees a large part of its sales coming from Instagram.

Product recommendation lists are highly underrated - these are critical when consumers look up “best suitcase to buy”. Away is usually on the top five of most of these lists, If your brand is populated on a list from an article that reads “Top 10 travel” suitcases, you’re golden.

Bose

Flighty: Founded in 2019, Flighty uses a freemium and premium subscription model at $50/year to share flight tracking information earlier than standard airline apps. It’s a little information overload but provides real-time stats as well as aggregates some data according to your travel behavior. For example, it tracks whether you’ve been on the same plane model more than once. From this to Spotify Wrapped to Duolingo streaks, our obsession with data continues!

The app generates $500K in revenue each month with a lean team of 3 employees and its latest feature includes a machine-learning algorithm that will allow it to predict delays up to six hours before airlines share this information.

Uber One: Uber is successfully building a loyal customer base from corporate benefits. Uber’s subscription plan, Uber One, is at 25M+ members and receives 4x the revenue from members than nonmembers. A huge perk of Uber One is the 6% cash back for every ride, so if your Uber rides are covered by work, that’s easy cash right to use for future rides. Additionally, Uber upcharges when it recognizes that I’m paying with a corporate card instead of my own card.

My prediction is that Uber Eats will become a close competitor with DoorDash in food delivery. It’s a bold prediction with DoorDash eating almost 2/3 of the market, but Uber has a strong hold with corporate spending.

Uber’s partnership with Marriot allows me to earn points for Uber Eats delivering food to my Marriot hotel. And now, there’s a waitlist for the Uber x Delta Miles program so you can earn miles for Uber rides and orders!

The more that Uber can extract spending from business-related travel, the easier it will be for Uber to lead in both the rides and food delivery market.

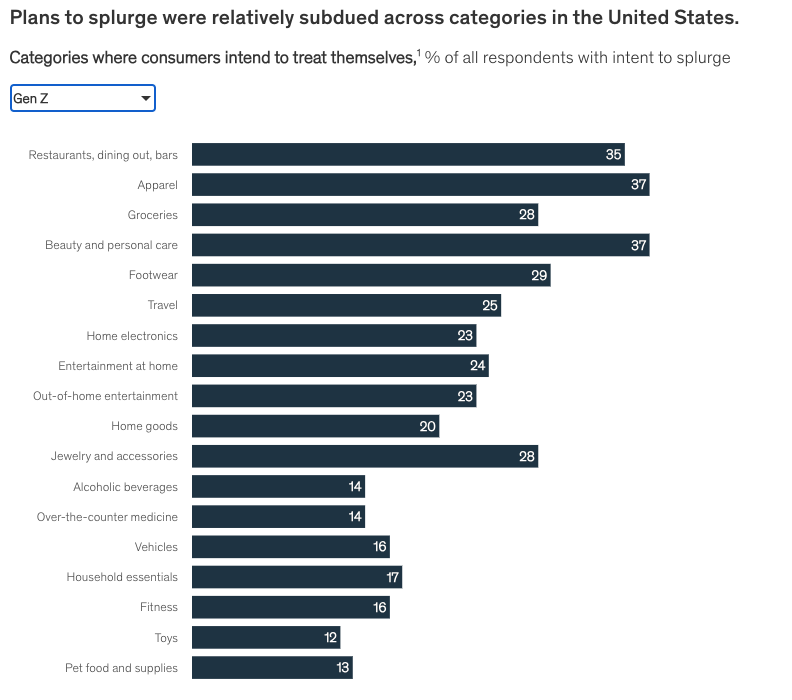

Beli: You’ll notice that many of these brands are just elevated, sleek versions of what currently exists today. Yelp and Google reviews are boring, but Beli offers a seamless way to track and rate restaurants all while sharing it with your friends. And with Gen Z spending more on restaurants and dining, as seen in the graph below, we need a place to track our experiences. The platform now sits at 600K followers on Instagram and will likely build strong partnerships with our favorite food content creators (mine is kaitlyneats)

Health & Wellness

Oura: I’ve talked about this in previous blogs, but our obsession with tracking our health is not short-lived. Wearables have been around for years, but Oura’s ability to track sleep is a unique competitive advantage that’s capturing a lot of young busy professionals who care about sleep health.

Classpass: If I didn’t have an existing gym membership, I would be using Classpass! The business model is incredible for people with unpredictable work schedules who don’t want to commit to a membership at one studio. There are plans for this company to go public in the next year, as it has seen a robust recovery of 65% growth compared to pre-pandemic levels. ClassPass also listens to the market’s demands. With Gen Z bullish on health and wellness spending, ClassPass has now started offering spas, salons, and group sports on its platform.

solidcore

Olive & June: Spending >$50 on nice nails every couple of weeks is sometimes just not in the cards. Olive & June’s $85 at-home manicure set has received a lot of positive attention over the past few years after the pandemic closed down a lot of the salons. The brand’s expected revenue for 2024 is $92M and has now entered an agreement with Helen of Troy, owner of notable brands like Hydroflask and Drybar, to become acquired.

Owala

Bloom Nutrition: Founded based on providing a high-quality supplement for fitness-focused women, the co-founders repositioned their brand to be more wellness-focused instead. This led the brand to become a first-mover in gaining young consumer interest on social media, despite other brands like AG1 having been around much longer. Bloom Nutrition has sold 6M+ of its Greens & Superfood powder blend and has reached nine-figure sales in 2023. As Bloom continues to lead in the market, I could see this brand creating a product SKU to support sleep health as it becomes a greater priority in 2025.

Food & Beverage

Nespresso

Spindrift

Celsius: While Red Bull still dominates the energy drink market, Celcius has been able to penetrate the market with its “better-for-you” position. While many Gen Z corporates have transitioned to coffee ****as it’s more aligned to corporate norms, Celsius still captures recently graduated Gen Z professionals who likely use energy drinks before exercise or for late working nights. Right now, it has captured 11% of the energy drink market but still keeps a pulse on other expansion categories to create a portfolio of products in the next 3-5 years.

Olipop & Poppi

sweetgreen: It’s amazing how this $15 salad has planted itself firmly in the lives of Gen Z corporates. As Gen Z becomes more conscious of the foods they’re eating and creating a sustainable lifestyle, sweetgreen is well-positioned to offer convenience without sacrificing health benefits. They are still not profitable — we’ve all seen this video about how sweetgreen isn’t making money, so hopefully in 2025 I can walk into a sweetgreen where a robot makes my salad. I’m rooting for this brand!

good culture

Chobani creamer: I remember seeing this all over my TikTok feed earlier this summer and was fascinated with Chobani’s bold appearance in the coffee market. Having just recently tried a few flavors, I understand the hype. When Chobani launched its creamers for the first time in 2019, four brands were controlling 80% of the market with oil-based products. Chobani’s strong commitment to real ingredients helped disrupt the market as it’s one of few brands using real cream without artificial preservatives.

Chomps: Founded in 2012, this better-for-you meat stick brand has sold 350M+ units to date. In 2024 alone, they’ve jumped 105% in gross revenue and have 181,000 points of distribution. This brand has somehow elevated a traditionally unsexy market, now making it the perfect snack for Gen Z corporates.

Coconut cult

Apparel & Footwear

Abercrombie & Fitch: Unsurprising, of course. Since A&F made a huge re-brand towards casual, minimalistic professional attire, they’ve been a top brand for Gen Z. Earlier this year, A&F posted the best Q1 in its history, reporting that net sales rose to just over $1B.

Aritzia: Profit grew 72% in Q3 of 2024 because of its strong e-commerce presence. With a strong value proposition to provide everyday luxury to its consumers, Artizia has a hold on corporate Gen Z. As its digital success has validated the brand’s potential, Aritzia is set to build more in-person stores in the US through 2025.

Madewell

Uniqlo

On Cloud & Hoka: Both brands have had a moment this year. Brands that start with a specific sports niche have a better chance of reaching the general public because athletes with strong preferences already validate the products — think Patagonia, Arc’teryx, and North Face. And since post-grad is when everyone starts training for marathons, it makes sense how these brands have received a lot more attention. Their marketing against Nike is strategic as they intentionally include individuals who aren’t professional athletes in their ad campaigns to promote that their brands are for everyone, not just athletes.

Skims: 70% of Skim’s revenue comes from Gen Z and millennials. Disrupting the shapewear market, Kim’s $4B brand has maintained a unique competitive advantage to deliver the highest quality shapewear in multiple skin tones and size options. This helps justify the steep price tag, but either way, it’s not a price that Gen Z hasn’t seen before

Lululemon: Despite the entrance of new athleisure brands in our orbit — Vuori, Outdoor Voices, Alo — Lululemon continues to be the leading brand for Gen Z. Likely because it’s one of few brands that many of us could grow up with, demonstrating the appeal to consumers of any age. For example, their specific best-seller is their black Wunder Under leggings, a product that can be used for working out or daily wear. I bought this at 15 years old and immediately committed to the brand. Now at 22, I find myself reaching for other tops and pants that wouldn’t appeal to me at 15 but serve as great athleisure for me now. Growing up with a brand makes a huge difference!

🛍️Products I’ve been loving

I guess I now fit into the demographic above :) Along with most of the brands above, here’s what I’m vibing with right now:

Ninja creami: I’m SO late to this trend, but I can finally eat ice cream every day

NYX lip liner in shade espresso: Gen Z was right, drugstore never dies

Off The Eaten Path chickpea crisps: clean-ingredient chips

The Only Bean: roasted edamame, high in protein and super great for salad toppings

Thanks for reading!

Sanjana