My 7 consumer predictions for 2024

Hi! I’m so excited to kick off my ✨ official✨ newsletter, where I’ll be sharing insights about the consumer industry. Fundamentally, every company is a consumer company, striving to deliver products that solve challenges individuals face. Understanding how consumer behaviors are shifting paves the way for new solutions to arise and for existing companies to scale. I’ve admired several investors and experts who believe in the growth of this sector, so I’ve decided to position myself in a way that I can continue learning about the space and share what I learn with others.

So, that being said, here are my predictions for consumers in 2024.

1. investing in experiences & community

Strava, a social platform where individuals can track and share their workouts with a broader network, has doubled the number of users on its platform since 2020. The number of people who run annually has not changed much, but Strava recorded that the number of runners who ran a marathon doubled in 2022.

This likely comes from post-pandemic behavioral shifts, where individuals are willing to invest in experiences. Eventbrite shares that more than 75% of millennials spend money on a desirable experience rather than products.

Social media has amplified the aesthetics associated with getting ready and going to a workout class in the morning, but it is encouraging a broader audience to spend on classes instead of working out in their apartment gyms. ClassPass, an aggregate fitness class booking platform, has seen 329% growth in fitness reservations since 2020 and 10% higher booking rates since pre-pandemic times.

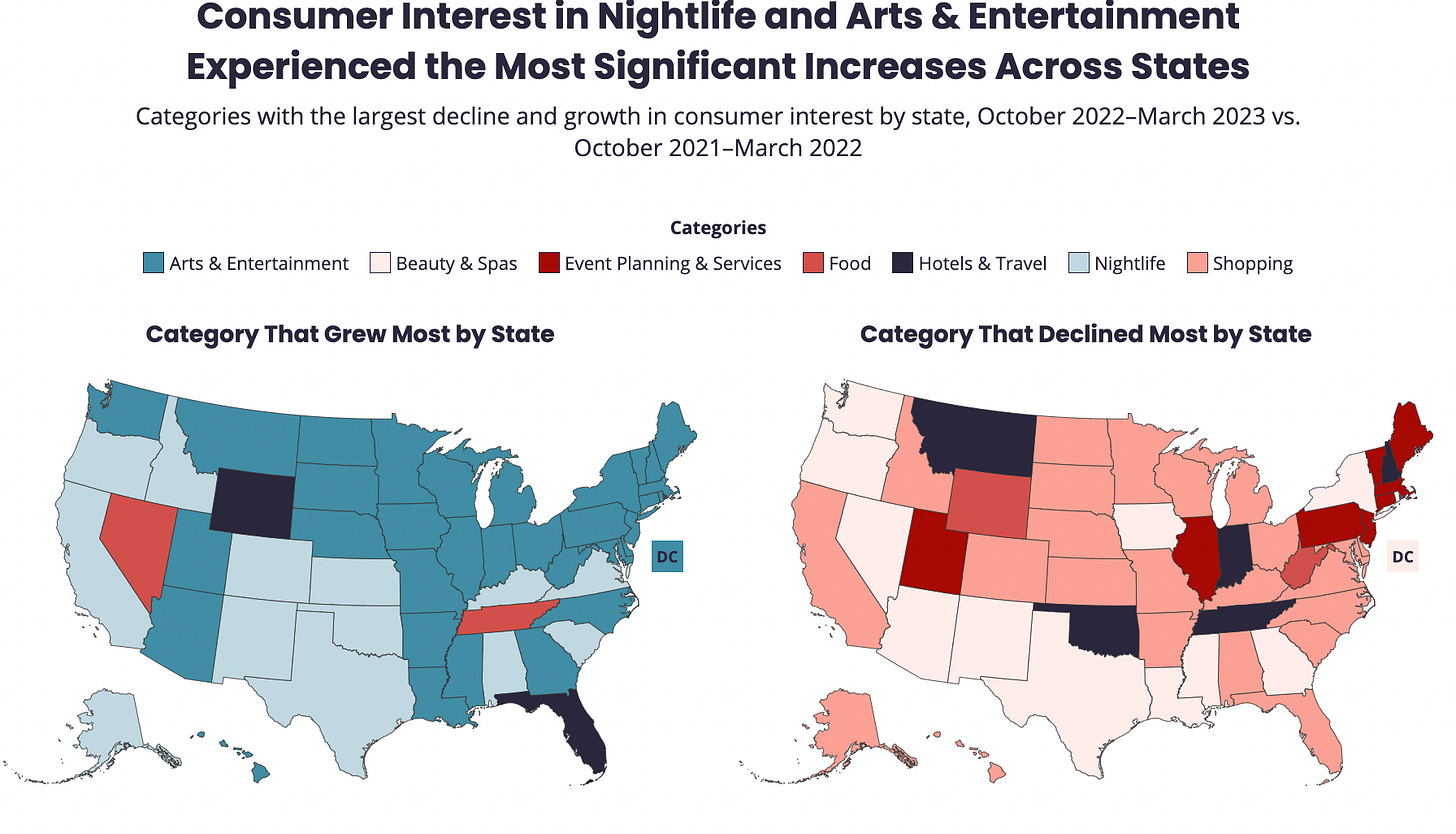

Food & entertainment are other “experience” areas that are likely to grow in 2024. Yelp reported that food and arts & entertainment had the highest consumer interest growth rate between this year and last. Consumers are also willing to spend more on the vibe of a restaurant rather than the food itself. Yelp shares that interest in higher-priced restaurants ($and$$) rose nearly 10% and 17%, respectively, compared to pre-pandemic levels.

2. welcoming non-alcoholic & spirit-free happy hours

Mintel reports that a “sober curious movement” exists, and 40% of survey respondents follow a sober curious lifestyle for physical health or mental health reasons. The concept isn’t new; the push for NA beverages kickstarted with incumbent beer brand Heineken, launching a 0% beverage in 2017 and later a large campaign in 2019 to “make non-alcoholic beer look cool”.

Penetrating the sober market is quite complex, as individuals still want to feel a part of a social gathering even if they are not drinking. Each part of a non-alcoholic beverage must be considered at a granular level, from packaging to taste to the overall vibe of the experience.

Non-alcoholic beverages take many forms, and that's what makes this market harder to break into. There are various ways to target a “sober curious” individual, and Statista found that food & non-alcoholic beverages have relatively low brand awareness. Therefore, this fragmented market lowers the barrier for smaller players to enter, as is clear by the market map I’ve created below.

According to Drizly’s Consumer Insights Report, 55% of Gen Z respondents said interesting and unique packaging drives their decisions towards what type of alcohol to buy. Brands that take a creative approach to packaging non-alcoholic beverages are likely to see more sales but will face challenges in achieving scale with numerous players in the market.

3. increasing brand exposure through innovative partnerships

Ever since I saw that false Lego x Birkin collaboration that generated a ton of hype, I knew that sparked a wave of ideas for brands to capitalize on unexpected, weird collaborations.

There are several examples of successful brand collaborations. In 2018, on April Fool’s Day, Warby Parker and Arby’s used their similar name (”wARBY”) to co-create a campaign where individuals could buy Arby’s-themed glasses.

These limited-time, rare offerings excite customers when two unrelated brands come together to launch fun products. 60% of survey respondents said that they have purchased special edition releases. Another example is in 2020 when Oreo collaborated with Supreme to launch red Oreos which sold out within hours.

4. subscribing to the subscription economy

The subscription economy has grown by 435% over the last decade, and it’s not done growing. There are many areas of growth, two in particular: diversifying pricing strategies to target different audiences and adding subscription services for originally product-focused companies.

A survey by Stripe shares the distribution of pricing models that companies use. Creating a sustainable pricing model dictates if a company can scale, and scalability depends on how a company caters to its various audiences.

Emerging startups, especially in AI, are in a critical stage of deciding if their businesses will sustain with a subscription model and how to price their business model. Stripe’s article quoted Midjourney’s CFO as she discusses that combining a tiered subscription pricing model with a usage-based one would allow the product to scale. Offering a range of subscription models eliminates the need to offer a freemium model, as the conversion rate for freemium models is typically 2-5% .

Even product-centric companies are exploring ways to add a subscription model. Express, a clothing brand, has launched a clothing rental service ( #7 on my predictions list) for customers to try a set of trendy clothing items each month. By strategically implementing subscription models on top of product-driven business, companies can create greater lifetime value with their customers.

With vertical SaaS on the rise due to rapid AI technologies, the subscription economy is going to see significant growth in 2024.

5. putting frozen groceries on the map

The pandemic has drastically shifted consumer behaviors more towards cooking at home rather than eating out. Especially with the economic uncertainty during that time, individuals were purchasing more frozen food than fresh groceries to stock up for a longer time. In 2022, Statista reported that 89% of survey respondents who were millennials cooked meals at home, and 73% for Gen Z respondents.

This inclination towards frozen foods is likely to grow. As Gen Z and millennials begin to cook meals and “fend for themselves”, we see more frozen groceries bought to mimic the cooking appeal that frozen meals do not offer. In regards to per capita consumption from 2019 to 2021, Statista found that the “frozen vegetables” category grew by 22%, but the “frozen meals” category decreased by 31%.

Ditching frozen meals, the younger demographic is bringing back the nostalgia of cooking meals regularly with the convenience of frozen ingredients that still deliver quality. In short, we’re going to see more meal-prepping videos on TikTok next year.

6. sustainable shopping starts with renting, not buying

Gen Z consumers are in a constant battle to be sustainable and maintain a trendy lifestyle. Well, to solve this issue, renting clothes has entered the chat.

Earlier this year, Rent the Runway was recorded to have more than 145,000 subscription members, a record high and a 7.6% increase from the previous year. However, a new company is putting pressure on Rent the Runway.

Nuuly is an online clothing rental platform spun off from Urban Outfitters. A key differentiator between Rent the Runway and Nuuly is the type of fashion that it promotes. Rent the Runway traditionally promotes high-end, luxury pieces; Nuuly took a different approach and instead offers minimalistic, everyday wear.

Nuuly has seen success with an 86% increase in sales, and 68% increase in subscribers. As said earlier in the subscription section, price predictability and access to variety will attract customers to Nuuly.

7. transforming homes one renovation at a time

According to Yahoo Finance, the housing market has slowed down due to high mortgage rates and home prices. Consequently, millennials are turning to renovating their own homes, a market that’s expected to reach $667B in 2025.

Spending on renovations has increased. A 2022 US Houzz and Home study found that median spending increased from $15,000 in 2020 to $18,000 in 2021. Renovations bring a “new house” feel without the inconvenience of moving to another home. These are particularly attractive since they can hike up the market value of your home as well.

A large consideration for homeowners is deciding to renovate themselves or hire a contractor. While there are several issues with outsourcing this work, it can encourage more homeowners to invest in renovations. An article found that 31% of survey respondents do renovations themselves, 28% hire a contractor, and the rest haven’t done a renovation

To solve the issue behind hiring bad contractors, startups such as Signoff are working to ease the burden off of DIY renovations to match homeowners with vetted contractors, aligning vision, budget, and timeline to benefit both parties.

Thanks for reading!

👩🏽💻xoxo, consumer girl